Strong customer feedback on Proxima Powered by REE and P7-B following fleet evaluations Company expects orders for multiple test fleets

- Successful customer evaluations of Proxima Powered by REE; orders expected to follow

- Ongoing customer evaluations of REE’s P7-B, with public road testing expected in the coming months

- Both P7-based electric vehicles are on track and on budget

- Continued on-time progress on integration centers ahead of anticipated 2023 start of production

TEL AVIV – August 16, 2022 – REE Automotive Ltd. (NASDAQ: REE) (“REE” or the “Company”), an automotive technology leader and provider of electric vehicle (EV) platforms, today announced its financial results for the second quarter of 2022. REE continues to execute on its milestones with a focus on commercialization of its P7 platform – revealing Proxima Powered by REE, a class 5 walk-in-van, and P7-B, a class 3 box truck. Execution remains on track and within our expected timeline and budget.

“We continue executing on our plan and remain on track and on budget as we make progress towards production in 2023. After the end of the quarter, we introduced Proxima Powered by REE, a class 5 electric walk-in van built with body manufacturing leaders EAVX and Morgan Olson. The first wave of product evaluations by leading delivery, logistics and e-commerce companies generated positive feedback: the competitive strengths of the vehicle resonated with prospective customers, and we expect orders from leading fleet operators for test vehicles in the coming months. We believe there is a significant opportunity to help companies achieve their commitments to electrification and carbon-neutrality, and we see the potential for substantial orders after real-world evaluations.” said Daniel Barel, REE’s Co-Founder and Chief Executive Officer. “Additionally, over the past several months, multiple e-commerce and logistics companies evaluated our new P7-B box truck and provided strong feedback on REE’s technology and ability to offer a turnkey, customizable solution. We expect to start delivering the first test vehicles to prospective customers in the near future so they can evaluate the P7-B in their fleets. For both Proxima Powered by REE and P7-B, fleet owners noted the game-changing nature of our technology, including enhanced maneuverability and safety with all-wheel steer and all-wheel-drive, the low step-in height for efficient delivery cycle times, superior ergonomics, and significantly less drag than the industry standard. These are all factors that provide operational efficiencies and driver wins, and we believe we are well-positioned in the last- and mid-mile delivery market as we prepare to scale production.”

Commercial Developments & Outlook

We believe that our ability to utilize multiple distinct go-to-market channels – directly to potential fleet customers with our P7-B box truck and through partnerships with body upfitters – is a strong competitive differentiator. This allows us to address a larger market and bring superior commercial EV solutions with a capex light approach. In both of these go-to market channels, REE is the Manufacturer of Record (MoR), in-line with the traditional commercial vehicle OEM market approach.

P7 Platform

Fully flat from end-to-end, the P7 platform, which was unveiled in January 2022, powers class 3-5 vehicles with payloads up to 8,000 pounds, range of up to 215 miles and all-wheel steering and drive. The P7 platform allows for unique user benefits, efficiencies, and flexibility enabled by REEcorners™ and their fully independent, x-by-wire control system. It is suited for applications across commercial trucks, walk-in-vans, recreational vehicles and school buses. REEcornerTM technology further allows for significantly reduced development times of electric commercial vehicles models.

Proxima Powered by REE

Together with EAVX, a subsidiary of JB Poindexter & Co and Morgan Olson, REE debuted and conducted evaluations by prospective customers of Proxima Powered by REE, a fully electric walk-in step van prototype. The vehicle highlights the benefits of the newly designed EAVX and Morgan Olson body paired with REE’s fully flat, modular P7 chassis and x-by-wire technology. Proxima Powered by REE checks all the boxes fleet customers are looking for, ultimately leading to lower total cost of ownership (TCO). The walk-in van offers increased interior space for cargo and passengers and a low step-in height while targeting a maximum speed of 75 mph (120 km/h), max range of 125 miles (200 km), up to 8,000 lbs. (3,630 kg) payload, and vehicle weight ratings (GVWR) of up to 19,500 lbs. (8,900 kg).

Benefits when compared with industry standard vehicles include:

- Greater volumetric and payload capacity

- 56% improved aerodynamics driving efficiency gains

- REEcorners™ x-by-wire technology enables minimal turning radius from all-wheel steer

- Industry leading maneuverability in urban zones and loading docks, as well as stability in adverse conditions

- Low load floor enables fast, easy accessibility for drivers and helps reduce delivery cycle times

- Driver-centric cabin design and smart VX digital infrastructure to increase safety, comfort, and connectivity

- 73% greater driver visibility boosting both driver and pedestrian safety

- Minimal down times from rapid REEcorner™ swaps

Following the evaluations, REE expects firm orders from customers in the coming months.

P7-B class 3 box truck for mid- and last-mile delivery applications

In response to market needs, REE debuted P7-B, a new class 3 box truck built on REE’s cab chassis designed for mid- and last-mile delivery applications. The box truck offers increased interior space for cargo and passengers and a low step-in height while targeting a maximum speed of 75 mph (120 km/h), max range of 150 miles (241 km), up to 4,400 lbs. (2,000 kg) payload, and vehicle weight ratings (GVWR) of up to 14,000 lbs. (6,350 kg). The configuration can be modified to best suit customer needs. The full x-by-wire architecture supports all-wheel steer and drive, adaptive regenerative breaking, creep control, hill start assist, and torque vectoring as standard as well as over-the-air updates.

The company is currently conducting customer evaluations for prospective delivery, logistics and e-commerce companies. REE’s P7-B leverages all-wheel drive and steer for unparalleled maneuverability and control. Its low step-in height is designed for faster delivery times than industry standard models. In addition, its superior aerodynamics and the highly efficient power management system of REE’s P7 platform architecture is expected to enable reduced energy consumption, all aiming to reduce total cost of ownership to help facilitate fleets’ transition to EVs.

The medium duty electric vehicle targets the important and growing mid- and last-mile delivery markets. P7-B is part of a test fleet in the UK accumulating testing, validation and durability miles in anticipation of start of production in 2023.

Operational Developments

REE has been focused on the build-out and validation of its first highly automated integration center and finalized the hiring of its core engineering team, bringing all key activities in-house and decreasing the Company’s reliance on third parties. The first integration center will be operational with a modular production line comprised of 13 automated manufacturing cells, and the Company anticipates it will have annual production capacity of 10,000 vehicle sets by the end of 2022. REE’s Austin, Texas, integration center is also progressing according to plan and is expected to double REE’s production capacity.

Financial Highlights & Outlook

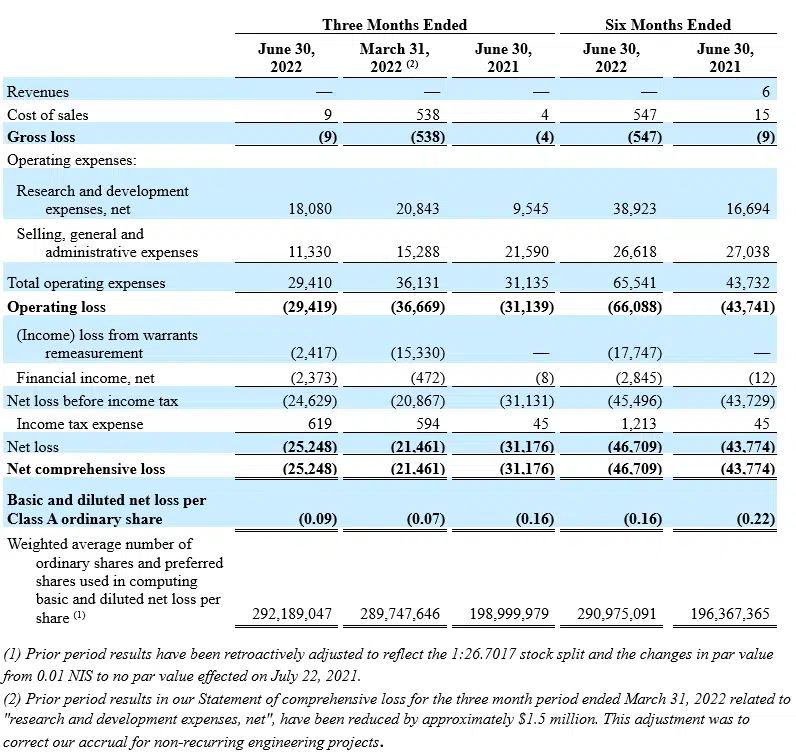

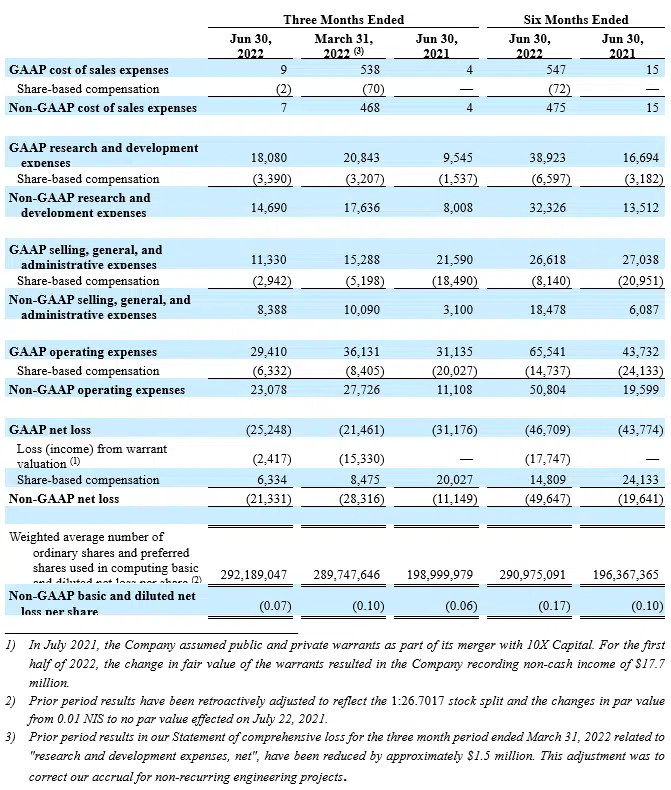

- GAAP net loss was $25.2 million in the second quarter of 2022 compared to $21.5 million in the first quarter of 2022 and $31.2 million in the second quarter of 2021. The increase in GAAP net loss compared to the first quarter of 2022 is driven by lower income from remeasurement of warrants, offset by a reduction in operating expenses. The decrease in GAAP net loss from Q2 2021 is mainly attributed to lower share-based compensation expense.

- Non-GAAP net loss of $21.3 million in the second quarter of 2022 compared to $28.3 million in the first quarter of 2022 and $11.1 million in the second quarter of 2021. The decrease in non-GAAP net loss versus the first quarter of 2022 is attributed to timing of expense recognition related to development and production capacity costs. The year-over-year increase in non-GAAP net loss is primarily related to higher operating expenses related to the Company’s execution of its business plan, including ramping up its capabilities and market penetration towards commercial production in 2023.

- The Company reiterates its 2022 full-year year guidance for non-GAAP operating expenses of between $100 and $120 million and expenses and investments related to the establishment of the Company’s initial production capacity of approximately $30 million. The expense expectations are dependent in part on the timing and achievement of certain milestones related to the Company’s commercial programs and projects.

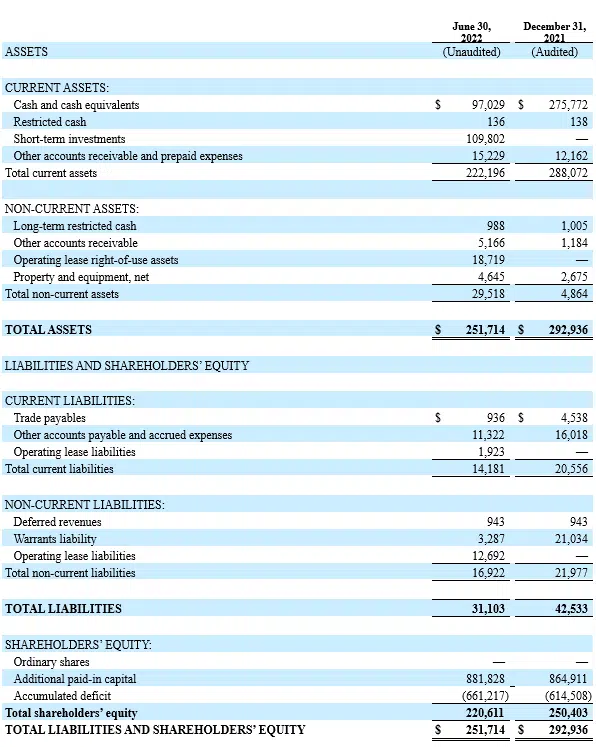

- As of June 30, 2022, the Company had $206.8 million of liquidity, comprised of cash and short term investments, and no debt. The Company anticipates that it has sufficient liquidity to achieve initial production of its P7 platform and continue to advance other commercial activities set forth above.

- REE today filed a shelf registration statement to allow REE to issue, at its discretion, from time to time in one or more offerings to the public, up to a maximum aggregate offering price of $200 million of REE’s Class A ordinary shares, debt securities, rights, warrants and/or units. REE intends to allocate up to $75 million of the shelf registration to the sale of REE’s Class A ordinary shares in an at-the-market program (the “ATM Facility”) to be entered into once the registration statement is declared effective. The shelf registration has not yet been declared effective, and no sales may be offered or sold under the shelf registration until it becomes effective. REE has no current plans to issue shares under the ATM facility.

Webcast and Conference Call Information

REE will host a conference call at 8:30 a.m. Eastern Time on Tuesday, August 16, 2022, to discuss results, recent developments and the Company’s commercial roadmap. This press release and the accompanying presentation materials will be accessible prior to the conference call at https://investors.ree.auto/.

The live webcast of the conference call can be accessed on the Events section of the Company’s website at: https://investors.ree.auto/news-events/events.

The conference call will be accessible domestically or internationally, by preregistering in the following link: https://register.vevent.com/register/BI210a48cbdf364921ab5fa4d10a7bfd30.

The link will also be provided at https://investors.ree.auto/news-events/events. Upon registering, each participant will be provided with a Participant Dial-in Number, and a unique Personal PIN.

The call will be recorded, and a replay will be available on REE’s Investors website at https://investors.ree.auto/.

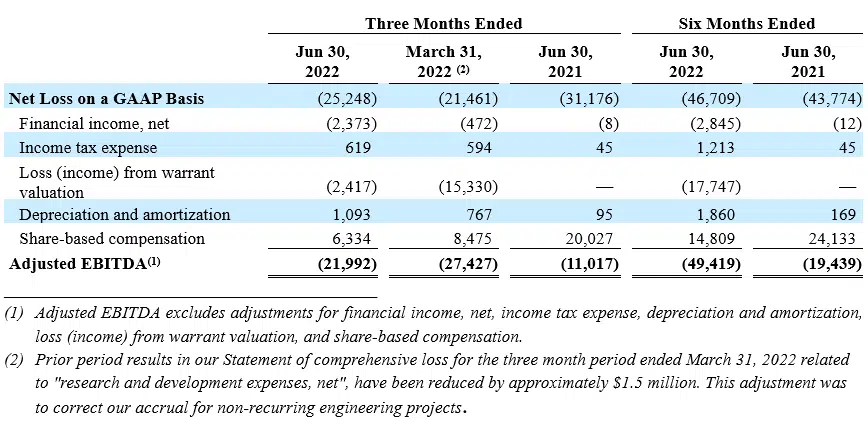

Use of Non-GAAP Financial Measures

The Company has disclosed financial measurements in this press release or elsewhere in its earnings materials that present financial information considered to be non-GAAP financial measures. These measurements are not a substitute for GAAP measurements, although the Company’s management uses these measurements as an aid in monitoring the Company’s on-going financial performance. Non-GAAP cost of sales, non-GAAP research and development, non-GAAP selling, general and administrative expenses and non-GAAP operating expenses exclude the impact of stock-based compensation. Non-GAAP net loss and non-GAAP loss per share also exclude non-recurring or unusual items that are considered by management to be outside the Company’s standard operations and certain non-cash items. Adjusted EBITDA is a non-GAAP financial measurement that is considered by management to be useful in comparing the profitability among companies by reflecting operating results of the Company excluding such items. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in the financial tables that follow.

The Company provides a reconciliation of non-GAAP operating expenses and Non-GAAP net loss for the three and six months ended June 30, 2022 below, however, the Company does not provide guidance on GAAP operating expenses and is unable to provide a reconciliation for its non-GAAP operating expenses guidance range without unreasonable efforts due to high variability and complexity with respect to estimating certain forward-looking amounts. These reconciliations include adjustment for stock-based compensation that are excluded from the calculation of GAAP operating expenses.

There are limitations associated with the use of non-GAAP financial measures, including that such measures may not be comparable to similarly titled measures used by other companies due to potential differences among calculation methodologies. There can be no assurance whether (i) items excluded from the non-GAAP financial measures will occur in the future or (ii) there will be cash costs associated with items excluded from the non-GAAP financial measures. The Company compensates for these limitations by using these non-GAAP financial measures as supplements to GAAP financial measures and by providing the reconciliations for the non-GAAP financial measures to their most comparable GAAP financial measures. Investors should consider adjusted measures in addition to, and not as a substitute for, or superior to, financial performance measures prepared in accordance with GAAP.

No offer of Securities

A registration statement relating to the shelf registration securities has been filed with the Securities and Exchange Commission but has not yet become effective. These securities may not be sold nor may offers to buy be accepted and no part of the purchase price can be received until the registration statement has become effective, and any such offer may be withdrawn or revoked, without obligation of commitment of any kind, at any time prior to notice of its acceptance given after the effective date.

Investor Relations

Limor Gruber

VP Investor Relations | REE Automotive

+972-50-5239233

investors@ree.auto

Kamal Hamid

VP Investor Relations | REE Automotive

+1 303-670-7756

investors@ree.auto

Media

Caroline Hutcheson

Head of Global Communications | REE Automotive

+1-252-314-2028

carolineh@ree.auto

About REE Automotive

REE Automotive (Nasdaq: REE) is an automotive technology company that allows companies to build any size or shape of electric vehicle on their modular platforms. With complete design freedom, vehicles Powered by REE are equipped with the revolutionary REEcorner, which packs critical vehicle components (steering, braking, suspension, powertrain and control) into a single compact module positioned between the chassis and the wheel, enabling REE to build the industry’s flattest EV platforms with more room for passengers, cargo and batteries. REE platforms are future proofed, autonomous capable, offer a low TCO, and drastically reduce the time to market for fleets looking to electrify. To learn more visit www.ree.auto.

REE AUTOMOTIVE LTD.

Condensed Consolidated Statements of Operations

U.S. dollars in thousands (except share and per share data)

(Unaudited)

REE AUTOMOTIVE LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands (except share and per share data)

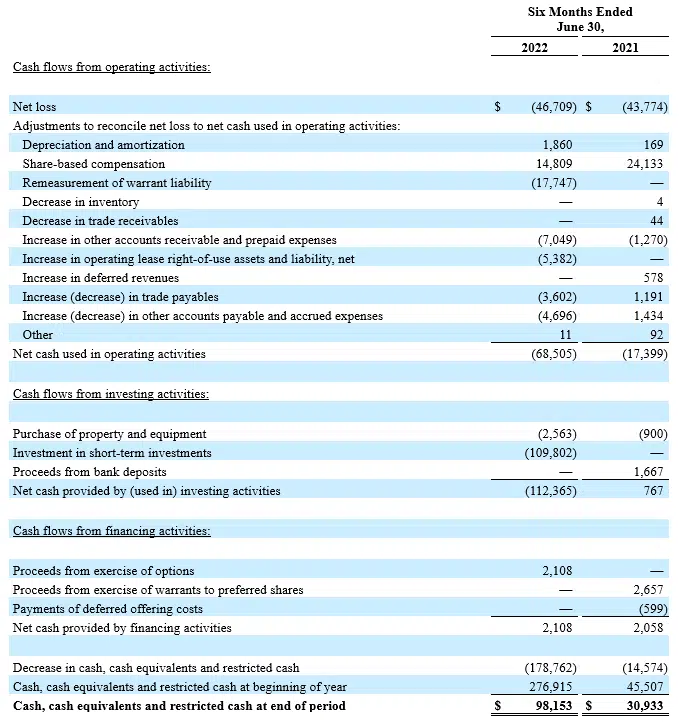

REE AUTOMOTIVE LTD.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

U.S. dollars in thousands

(Unaudited)

Reconciliation of GAAP Financial Metrics to Non-GAAP

U.S. dollars in thousands (except share and per share data)

(Unaudited)

Reconciliation of Net Loss to Adjusted EBITDA

Reconciliation of GAAP cost of goods sold to Non-GAAP cost of goods sold; GAAP research and development expenses to Non-GAAP research and development expenses; GAAP selling, general, and administrative expenses to Non-GAAP selling, general, and administrative expenses; GAAP operating expenses to Non-GAAP operating expenses; GAAP net loss to Non-GAAP net loss, and GAAP net loss per Share, basic and diluted to Non-GAAP net loss per Share, basic and diluted

Caution About Forward-Looking Statements

This communication includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding REE or its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “aim” “anticipate,” “appear,” “approximate,” “believe,” “continue,” “could,” “estimate,” “expect,” “foresee,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “would,” “outlook” and similar expressions (or the negative version of such words or expressions) may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. All statements, other than statements of historical facts, may be forward-looking statements. Forward-looking statements in this communication may include, among other things, statements about REE’s strategic and business plans, technology, relationships, objectives and expectations for our business, the impact of trends on and interest in our business, intellectual property or product and its financial outlook and future results, operations and financial performance and condition

These forward-looking statements are based on information available as of the date of this communication and current expectations, forecasts, and assumptions. Although REE believes that the expectations reflected in forward-looking statements are reasonable, such statements involve unknown number of risks, uncertainties, judgments, and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements. These factors are difficult to predict accurately and may be beyond REE’s control. Forward-looking statements in this communication speak only as of the date made and REE undertakes no obligation to update its forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this communication may not occur.

Uncertainties and risks that could affect REE’s future performance and could cause actual results to differ from those projected in forward-looking statements include, but are not limited to: REE’s ability to commercialize its strategic plan; REE’s ability to maintain and advance relationships with current Tier 1 suppliers and strategic partners; development of REE’s advanced prototypes into marketable products, including its ability to complete testing and subsequently produce and market the Proxima Powered by REE and the REE P7-B; REE’s ability to grow and scale manufacturing capacity through relationships with Tier 1 suppliers; REE’s estimates of unit sales, expenses and profitability and underlying assumptions; REE’s reliance on its UK Engineering Center of Excellence for the design, validation, verification, testing and homologation of its products; REE’s limited operating history; risks associated with plans for REE’s initial commercial production; REE’s dependence on potential suppliers, some of which will be single or limited source; development of the market for commercial EVs; intense competition in the e-mobility space, including with competitors who have significantly more resources; risks related to the fact that REE is incorporated in Israel and governed by Israeli law; REE’s ability to make continued investments in its platform; the impact of the ongoing COVID-19 pandemic and any other worldwide health epidemics or outbreaks that may arise; and adverse global conditions, including macroeconomic and geopolitical uncertainty; the need to attract, train and retain highly-skilled technical workforce; changes in laws and regulations that impact REE; REE’s ability to enforce, protect and maintain intellectual property rights; REE’s ability to retain engineers and other highly qualified employees to further its goals; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in REE’s Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 28, 2022 and in subsequent filings with the SEC.